Individual Retirement Arrangements (IRAs) are retirement funds to be used during the IRA Holder’s retirement. As you may be aware, contributions to a Traditional IRA, SEP-IRA, and SIMPLE IRA are generally pre-tax*, meaning the IRA Holder will not be taxed on the contributed amount in the year “for which” the contribution is made. This is intended by Congress and the Internal Revenue Service (IRS) to encourage the average American to save intentionally for retirement. In addition to the contributions being pre-tax*, the earnings are also tax deferred.** This means that neither the contributions* nor the earnings are taxed by the IRS until they are distributed from the IRA. **

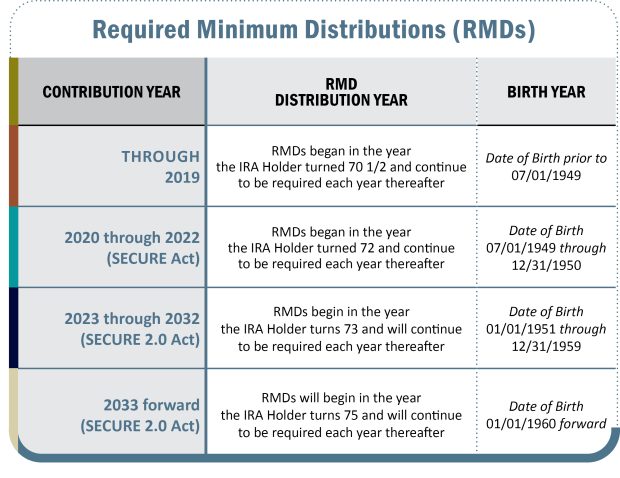

Based on this information (retirement savings and pre-tax assets), the IRS has established rules that require the IRA Holder to begin distributing funds from the IRA during their likely retirement years. These distributions are called IRS Required Minimum Distributions (RMDs). Unlike 401(k) RMDs, there are no regulations allowing IRA RMDs to be postponed if the IRA Holder is still working at the applicable ages. Therefore, RMDs must be taken every year after a specified age (see chart below):

The RMD is based on the prior year’s December 31 Account balance and on the IRA Holder’s distribution period.

RMD statements will be sent to the IRA Holder in January of each year that an RMD is required. Financial organizations are not required to send copies of the RMD statements to the IRS, however, the RMD requirement is communicated to the IRS via the previous year’s IRS Form 5498, which is due by May 31. For example, an RMD due in 2024 will be reported on the 2023 IRS Form 5498, which will be sent out in May 2024.

Please reach out to your financial representative or agent for any questions on your RMD. We’re always here to help and look forward to hearing from you.

* Based on marital status, age, and earned income requirements.

** If IRA Holders violate certain rules governing IRAs (called prohibited transactions), the funds may not only be taxable prior to a distribution but may also result in a penalty being assessed due to the violation. For more information regarding prohibited transactions, please contact your Qualified Tax Advisor.